Bits of Everything

Whitehall Gym Expenditure Passes

The Whitehall Times reports on the vote to spend tax dollars on a school with plummeting enrollment. One little-reported fact in this whole story is that the roof being replaced was installed in 1991, which means it lasted only 18 years. Most roofs should last a minimum of 25 years. Oh what the heck, it’s only a couple of hundred thousand.

Washington County Sales Tax Revenue Falls

Some bad news here. The Post Star tells us that Washington County sales tax revenue is down.

Unreleased Jimi Hendrix Music Coming Soon

I don’t want to finish this post on a down note, so here’s good news from Beat Crave if you’re a Jimi Hendrix’s music lover.

Now For Some History: Whitehall Canal

What is Old is New Again

The metal cross that adorned Our Lady of Angel’s Church in Whitehall, has been repaired and now overlooks Our Lady of Angel’s cemetery.

Previously, I had linked to this Post Star story which told about local parishioners salvaging and repairing the cross which sat atop Our Lady of Angel’s Church in Whitehall. In the picture that ran with that story, you can see the cross sitting on top of the church as it was being demolished.

I am happy to report that the cross was re-dedicated on August 22nd and now overlooks Our Lady of Angel’s cemetery.

School Tax Bills Received

More local property will go on the market soon because people can’t afford their school tax bills. Out of control spending by the school board is causing property owners to sell their parcels.

If you are a property owner in Huletts, you just recently received your school tax bill for 2009-2010. I had two calls this week from people who have decided to put their homes up for sale because they can no longer afford the school taxes. One person told me; “I just can’t pay my school taxes. I have to sell.” I will continue to post pictures of businesses that have closed and cease to exist in Whitehall. The school board’s continued policy of overcharging, putting the funds in reserve accounts and spending on capital improvements, while enrollment is plummeting is a complete outrage.

Whitehall’s steep decline is a testament to this flawed tax and spend policy.

What can be done?

1.) Have committed tax-cutters run for the school board and tell the school board members how you feel when you receive your tax bill. Ask questions. Why isn’t spending tied to enrollment? Why are businesses closing and for-sale signs appearing everywhere? You can be sure the board hears from the education establishment when setting the budget. They should hear from the taxpayers also. Here is the board of education that sets the budget. Only one person comes from Dresden.

2.) Understand the taxing policies of the school district. Know how the equalization rate effects our school taxes. What is this? By law, equalization rates are used to apportion taxes in taxing jurisdictions that cross municipal boundaries. These taxing jurisdictions are usually school districts.

The tax levy for the Whitehall school district is spread over the five towns it serves. Whitehall, Dresden and parts of Granville, Hampton and Fort Ann make up the district.

In a perfect world, all would pay the same tax rate based on their property being assessed at market value. However, because individual towns decide when their property will be reassessed, some towns are assessed at 100% of market value while others are not. NY state thus sets an “equalization rate” to apportion taxes equally among towns with different methods of calculating their assessment rolls.

The total tax levy for the district this year is $4,829,164.

This is where it gets a bit complicated and we need to put our thinking caps on.

Dresden has a low equalization rate of 45.53 % because we have not done a reassessment for a long time. So while the Dresden tax roll shows that Dresden has $129,001,445 in taxable property, NY State after applying the equalization rate calculates that the total assessed value of Dresden property is $283,332,846. Dresden thus pays $2,713,201 of the tax levy or 56.1% of the Whitehall school budget.

Whitehall’s equalization rate is 100% because they reassessed the town recently and went to 100% valuation. Their taxable property is carried at $196,081,028 and they pay $1,875,903 of the tax levy or 38.8% of the Whitehall school budget.

Hampton also has an equalization rate of 100% but their total assed value for the property within the district is only $23,410,183. Thus they only pay $223,724 or 4.6% of the Whitehall school budget.

Fort Ann has an equalization rate of 100% but little property served by the school distinct. Assessed property is $2,166,122 for a tax levy share of $20,724 or 0.4% of the Whitehall school budget.

Granville has an equalization rate of 77.51 % but has relatively little property within the district. The taxable assessed value of their property is $678,200 so Granville pays only $8,379 of the tax levy or 0.1% of the Whitehall school budget.

Should Dresden reassess and go to 100% of full value bringing our equalization rate in line with Whitehall, Fort Ann & Hampton? Only if you believe the town-wide assessment is too high and your assessed value is too high. How can you figure this out?

On your tax bill there is a column marked “Taxable Value or Units”, take that number and divide it by .4553 (Dresden’s equalization rate) and that is what NY state considers the full or fair market value of your property.

Taxable Value or Units on Tax Bill / .4553 = what NY says your property is worth.

If you think that this value is higher than what you would sell your property for, you would probably want your property to be reassessed.

If you think that this value is lower than what you would sell for, you probably don’t want your property to be reassessed.

I am not advocating for or against reassessment at this time but I want people to understand the issues involved. Because Whitehall is a town in significant decline and Dresden is not, this imbalance will most likely continue. We need to consider strategies that will work to lower taxes for all.

If the Town of Dresden was to reassess and the new town-wide total came in at an amount above the adjusted total of $283,332,846 that NY state says our property is worth (as adjusted by the equalization rate) we would pay an even higher share of the Whitehall school tax budget.

If the Town of Dresden was to reassess and the new town-wide total came in at an amount less than the adjusted total of $283,332,846 that NY state says our property is worth (as adjusted by the equalization rate) we would pay a lower percentage.

At its core, this issue is one of overspending by the Whitehall school board, the assessed value of property is only a way of spreading the taxes around.

I’d like everyone to try this calculation and give me your feedback. The bottom line is that in return for paying 58.1% of the school budget, Dresden gets very little in return. When you have one town paying this large a share with practically no representation, and a school board hell bent on destroying their own community through poor tax and spend policies, you have the situation we are all in today.

Sadly more people will end up selling because of the short-sighted policies of the Whitehall school district. That is the real tragedy.

Bits of Everything

Man Wanted for Murder Arrested in Whitehall

The Post Star reports on an arrest made this week in Whitehall.

Triathlon Scheduled for October

The Adirondack Almanack reports on the Rogers Rangers Challenge triathlon scheduled for Saturday, October 3rd, in the area.

Study Shows Men Lose Their Mind Talking to Pretty Women

There is now proof! Beautiful women have an effect on men. Read about it in the Telegraph.

Now Becoming the Weak State: Business Must Now Pay Tax to Collect Sales Tax

Forget the empire state, we’ve become the tax state! This Times Union piece illustrates what NY has become.

Hold the Trash

Just a quick note that the Whitehall transfer station will be closed on the Saturday of Labor Day weekend. If you were planning on bringing trash over on Saturday, you’ll have to wait until the following Wednesday.

Bits of Everything

Ravens Lose Adam Terry for Season

I’m sorry to report that the Baltimore Ravens have lost offensive lineman and local standout, Adam Terry, for the season. Adam was gracious enough to allow me to interview him while the Ravens were making their playoff run last year. His interview is one of the most read posts on the Huletts Current to date. Hope you get better soon Adam.

Broadband Internet Sought for Adirondacks

This article in the Times Union describes the effort to bring high-speed Internet to the Adirondacks, where 70% of the population has no connectivity. While Huletts has been fortunate in this regard, I feel bad for small towns where there is no Internet or cell phone coverage. Without these, there’s no real hope for growth.

Residents Plan to Restore Cross

The Post Star has a heartwarming story about the cross that sat on top of Our Lady of Angel’s in Whitehall.

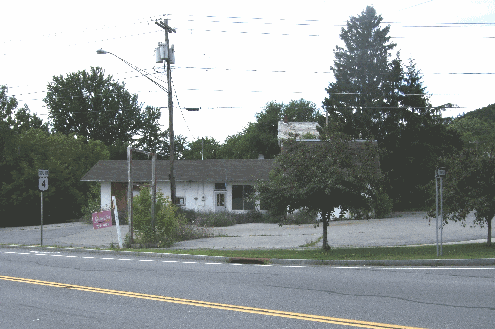

There They Go Again

Another building sits idle and “for sale” in Whitehall because of bad tax and spend policies put in place by the school board.

The Whitehall School Board has set the date of September 25th for a special election to decide on proposed renovations to the high school gymnasium with a cost not to exceed $525,000.

Along with this vote the board added another vote to purchase a pair of vehicles that would allow the school to spend no more than $120,000.

Instead of voting to return these excess funds back to the taxpayers in the form of lower taxes, this excess from last year will be spent on projects in a school district with falling enrollment.

From now on, every story I do about the school district will be accompanied by a picture of a building or house for sale in Whitehall. I drove around last week and have never seen so much property for sale. The school board’s tax and spend policies are now killing Whitehall itself.

The powers that be might be thinking that they’re getting away with this but I hope no school board member intends to sell their house anytime soon. If you go down almost any street in Whitehall, multiple houses are for sale. It’s no longer businesses that are fleeing – now it’s people also.

What’s the school district going to do with a new gym and a lot of school buses when no one is left?

An Interview with Father Flannery

Fr. Flannery, pastor of Our Lady of Hope in Whitehall and the Chapel of the Assumption in Huletts Landing, stands overlooking Lake George.

It was my great pleasure recently to get together with Fr. Michael Flannery who is pastor of Our Lady of Hope in Whitehall and the Chapel of the Assumption in Huletts Landing.

Father agreed to chat with me about a wide range of topics.

Father, one of the things I’ve noticed about you is that you have a wonderful sense of humor and people can really tell you enjoy being a priest. Could you tell our readers what you like most about being a priest?

“I love saying the Mass every day most of all, and it’s a wonderful privilege being involved in people’s lives. I get to see family life at so many different levels. Last week, I went from saying a funeral mass in the morning to doing a baptism in the afternoon. Usually baptisms are done on Sunday’s but this was a special case because the baby’s father was a soldier in Afghanistan. I honestly love it all except the administration. (Big laugh.) Our culture has become so secularized but the world will return to Christ someday, and I feel like I’m carrying the torch for future generations.”

Father, perhaps you could tell us about your own family growing up. I know your parents live nearby.

“Well, I lived on Long Island until I was 14 and then my family moved to Granville. My father worked as a general contractor and, for a short period starting in 1992, he worked as a corrections officer in Great Meadow corrections facility. Both my mother and my father attend my masses regularly and it’s nice to live close to them. I have one brother.”

That was probably a perfect segway to my next question. Is part of your “territory” Great Meadow corrections facility?

“Great Meadow actually falls within the boundary of Our Lady of Hope parish, but they have their own ministry office which is staffed by another priest. I do say Mass and hear confessions there occasionally though.”

Prisoners are largely a forgotten population. Could you tell our readers what it is like to walk into a prison as a member of the clergy?

“The inmates there actually are extremely respectful of the clergy. I have never had a problem. Their confessions are certainly not your typical confessions. I sense great remorse in speaking to prisoners and a great fear of the Lord. It’s not a show for them, it comes from the heart.”

Is it safe for you?

“I don’t think in those terms. There’s a large officer presence, but my job is to bring the Gospel message into the walls. God always takes care of the rest.”

Father could you share some about your education and the call to your vocation?

“The short story is this. There has never been a time in my life when I felt God wasn’t calling me, even as a young boy. My parents never mentioned becoming a priest to me. I thought at first I was being called to family life because I always wanted a big family. However, I began to feel that God was calling me to become a priest when I was a freshman at Siena.

I actually have a distinct moment when this happened. I was heading home on President’s Day weekend in 1989 and I told God, ‘I’ll be a priest if you want but I want a sign and you’ll have to break it to my parents’ because I knew if I became a priest they probably wouldn’t get any grandchildren because at that time my brother wasn’t the settling down type of guy.

I got home and I was standing in the kitchen and my mother said to me, ‘Have you ever considered becoming a priest?’ and I just knew. I cried tears of joy that night because in that very moment I knew God was speaking to me.

I went on to Wadhams Hall Seminary and then Catholic University. I have now been a priest for 12 years, and I have to say I’ve enjoyed every minute of it.”

Father what a wonderful story. What would you say to a young man or woman who is considering religious life today?

“Pope John Paul II said it best: “Be not afraid.” The biggest point I would make is that the lines our culture feeds you are all wrong. You’ll hear these thoughts: you’ll never be happy, you’ll be lonely, you’ll miss out on family life when in actuality it’s the reverse: You’ll have true joy, you won’t be lonely and you’ll have an extended family like you’d never expect. Don’t give in to the lines and the negative thoughts. They’re not true. Look where God has led me. He has called me to the clean waters of Lake George at Huletts Landing and the wonderful rolling hills of Washington County, probably one of the most beautiful areas in the entire world!”

Father I know in your travels you have been to many places. How does Huletts differ?

“Huletts is unique because there’s a core community there that doesn’t change but every week we have visitors and guests whom I really enjoy meeting. I look forward in the winter to seeing everyone again. It’s a community like none other.”

One last message for our readers?

“Please tell everyone, I pray for them all the time and I wish God’s abundant blessings on everyone. Always feel free to stop and chat, I enjoy meeting everyone and sharing in their life’s story.”

Rainbow Over Route 4

On the way back to Huletts last night, as we were driving north on Route 4, we came across a brilliant rainbow. So we stopped and I was able to shoot some video. So here it is.

httpv://www.youtube.com/watch?v=YiKNm3Gjtf4

Bits of Everything

Here’s One Vote for Option 1: Buzz Saw the Budget

The Post Star had an article about the three options that the Washington County Supervisors are considering in regard to this year’s budget.

Whitehall Canal Festival

The annual Whitehall Canal Festival will be held July 10 & 11. It’s free. Learn more about it here.

Bits of Everything

Post Star Editorial: Whitehall Police

Read the Post Star’s editorial in favor of turning over the Whitehall police force to the Washington County Sheriff.

Springsteen to Play SPAC

Read how to get tickets for Aug. 25th.

“It’s Nicer on this Side”

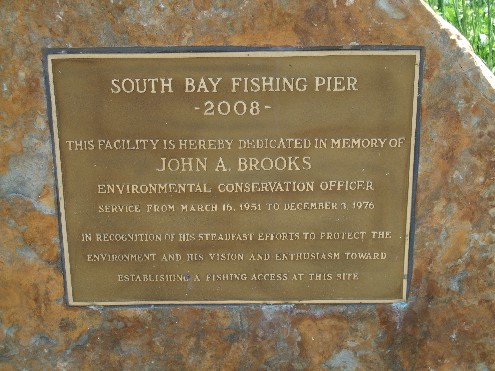

Yesterday, on the way back from Whitehall, I stopped at the pavilion/walkway out over South Bay on Lake Champlain. I don’t want to beat a dead horse, but this little improvement shows the difference between how Dresden and Whitehall are facing their future.

Dresden Town Supervisor, Bob Banks, spearheaded this initiative a few years back and it’s a nice improvement. I met a couple from Whitehall and they said they loved fishing on the Dresden side because; “It’s nicer on this side.” There’s a parking lot, benches, the pavilion on the end, etc.

On the Whitehall side, there’s nothing and they haven’t even tried to improve things.

I’m going to be doing a story soon, on all the businesses that have closed in Whitehall over the last few years. It’s analogous to not seeing your nieces or nephews for a few months and seeing how they have grown. Except in Whitehall’s case it’s the reverse, when people come back for the summer they notice how things have declined.

I wish there was a concentrated effort by the Whitehall town fathers to do something, anything to stem the decline. It’s always more of the same though; “What can we do?”

Come up with a plan. That’s what. Try to bring business to the town, start or try to attract a college to come here, make the facades of the buildings like an alpine village. CUT TAXES. I don’t have the answer but try something. Use what you have and try. It’s a major thoroughfare to Vermont, get people to stop.

Getting back to the South Bay pavilion though, it’s dedicated to John Brooks who was the conservation officer for many years. I remember him as a child because he would issue permits for burning leaves, etc. and it always amazed me that he carried a gun. (He had to confront poachers and people hunting illegally who were armed so it makes sense.) As a child, he taught me things about the environment that I still remember to this day. I wish there were more people like him. I sense the environmental movement is creeping to an extremism that forgets people are part of the equation. That’s why I took a picture of the dedication to John Brooks that meets visitors to the pavilion.

He always gave me the sense that he would protect the environment but he also wanted people to enjoy the environment also. That’s why the last line of the dedication really hit home for me. He understood that there has to be access for PEOPLE to enjoy the environment.

Vision and enthusiasm are definitely needed on the Whitehall side.